In the world of rap, the saying is true — more money, more problems.

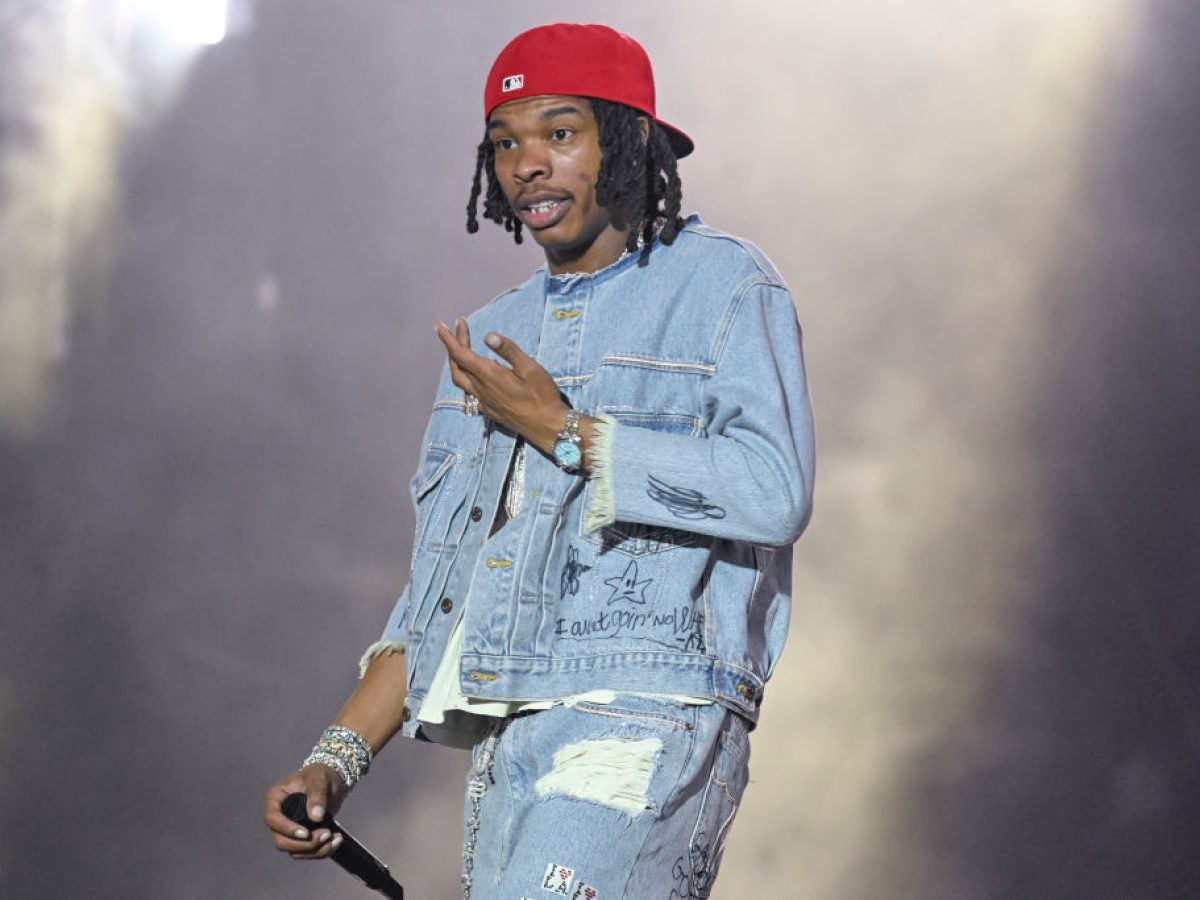

And for Lil Baby, one of the hottest artists out at the moment, the transition from hustling in the streets of Atlanta to earning over $100 million in record deals and endorsements came with a harsh financial wake-up call. The rapper recently shared how he unknowingly navigated the early years of his career without understanding one critical responsibility: paying taxes.

“I done got over $100 million from labels and deals. Not one time nobody still haven’t told me how to pay my taxes. Nobody even never told me pay my taxes,” Lil Baby shared during an interview on “A Safe Place Podcast.”

The rapper admitted his early lack of financial knowledge led to substantial tax bills, revealing he didn’t pay taxes the first two years, “I was doing it so wrong, my first tax bills was so high ’cause I was on some hustling sh-t like saving all my money. The more money I was saving, I owed the IRS more money. I didn’t know you needed to be spending your money, so you can save money on your taxes.”

Lil Baby’s experience isn’t unique in the music industry, but he wants to help those behind him so they don’t experience the same tax issues. “The rappers I meet, I try to tell them,” he shared. And he’s not wrong for wanting to lend a helping hand — numerous artists have faced similar struggles, with some even facing legal consequences. In 2013, rapper Fat Joe served four months in prison for failing to pay taxes on over $3 million in earnings. Lauryn Hill also made headlines in 2012 when she was sentenced to three months in prison for tax evasion after neglecting to pay nearly $1 million in taxes over a three-year period.

These stories highlight a persistent issue — many artists are thrust into immense wealth without the financial education needed to manage it responsibly. Lil Baby now approaches his finances differently, paying taxes quarterly and working with accountants. His first step was seeking advice from peers like Rick Ross and 21 Savage. “Only thing I knew how to do was spending… I started looking at the people that I saw with the right business,” he shared.

His transparency on the subject serves as a cautionary tale and a call to action. Artists, particularly those from marginalized communities, often face a steep learning curve when it comes to financial literacy. Without proper guidance, wealth can quickly turn into liability.