Adulting comes with a lot of new responsibilities but nothing is more important than finances. Since they don’t exactly teach real world budgeting in the classroom, these are the apps you can use to make up for lost time that will school you in all things making your money last so you aren’t always pinching pennies.

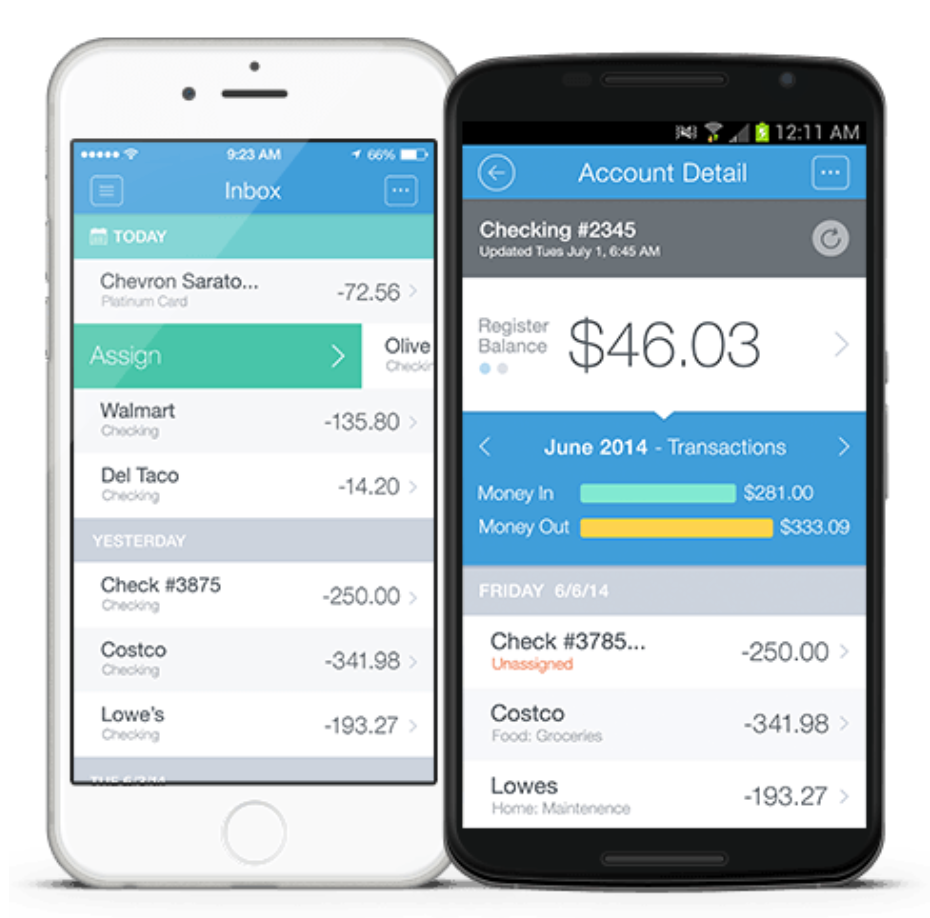

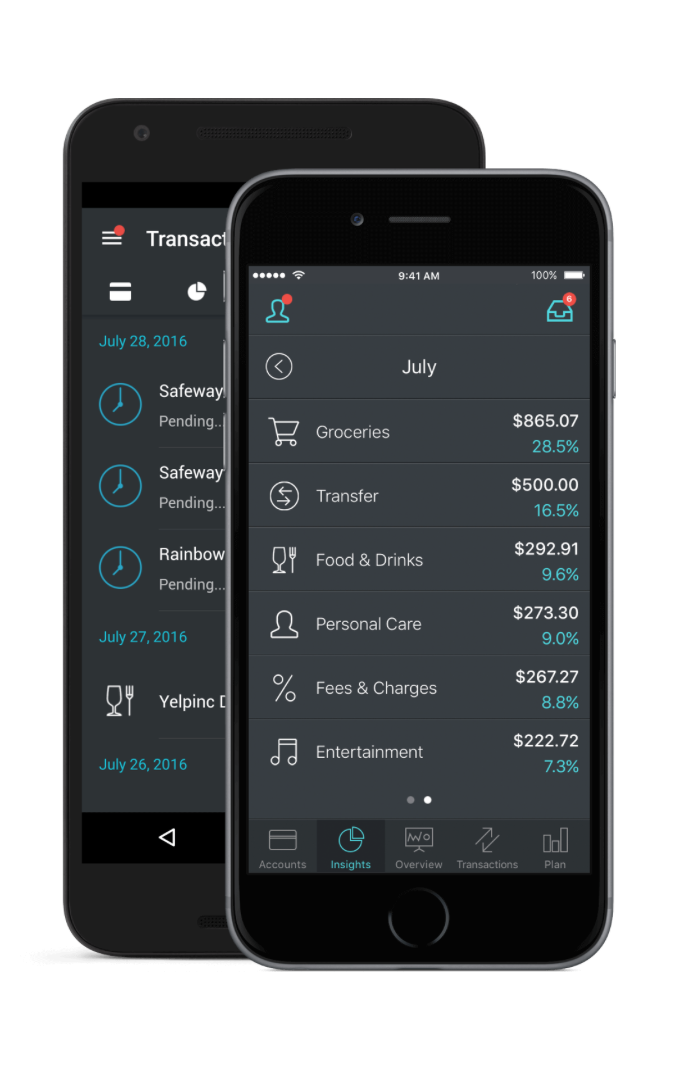

With a smart inbox, Prosper Daily let’s you see all your transactions based on category. You can also customize how things are organized–like streaming service subscriptions, take-out orders, shoe purchases, etc–so you can easily decipher where your money is going.

Budgets are never fun but lucky enough, Mvelopes does it for you! The app makes it simple and easy to come up with a money map that you can actually stick to on the road to being financially competent.

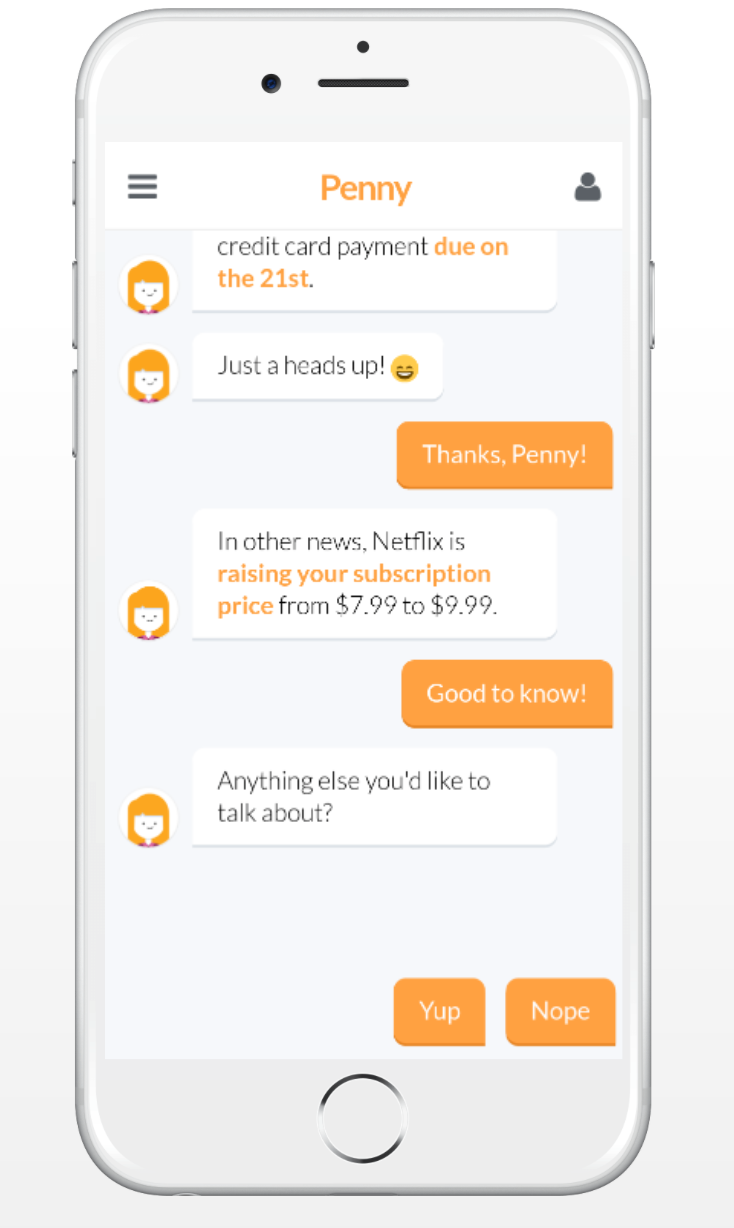

Think of Penny as the financial friend that helps you keep your coins in check…forreal. The app is like a personal finance coach that gives you the heads up on recent deposits, upcoming bill payments and more.

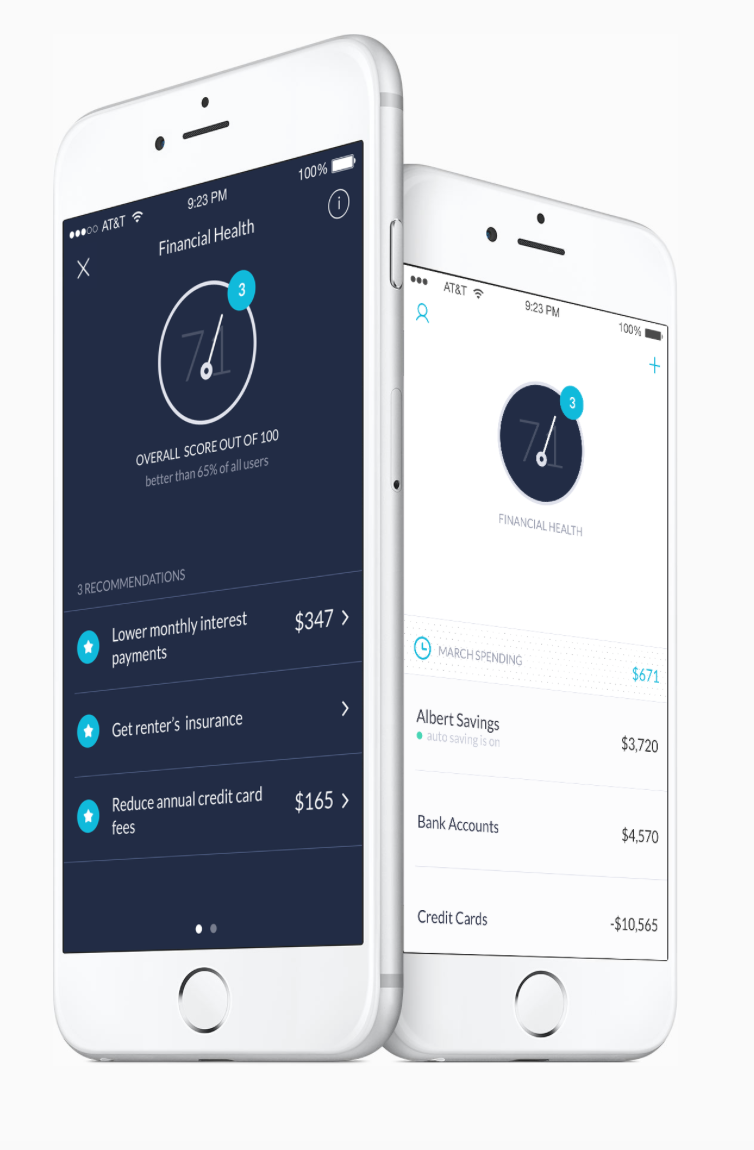

Keeping all your financial info in one place is a lifesaver and this app gets it. With Albert, you can sync all your account info and you’ll get real-life recommendations on how to improve some of your monetary decisions.

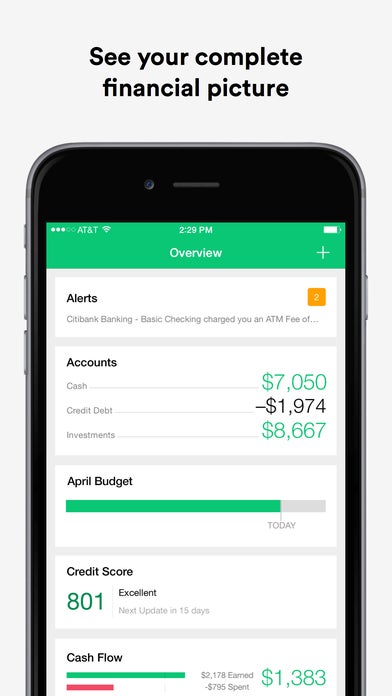

Mint is great way to track your spending week by week. With a simple and convenient analysis of where your money goes, it offers a breakdown of your financial habits and provides transaction trends that you may not notice.

Like keeping everything in one place? PocketGuard is great storage for all your accounts and all your finances. What makes it even better, you can organize your expenses, plan for payments on your monthly bills and create graphs and tabs for an easy and comprehensive tracking of all your monetary needs.

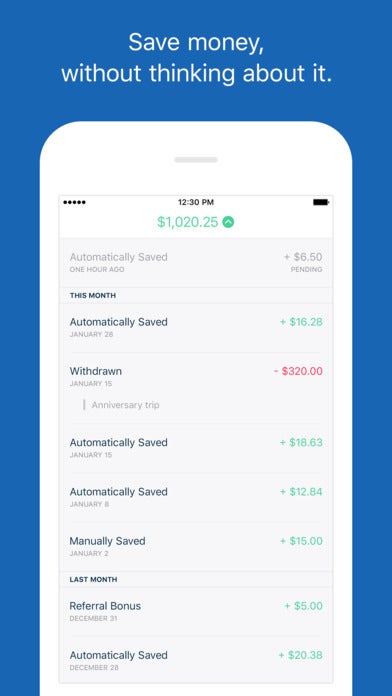

Digit helps your save your chump change for something specific (the perfect holiday getaway) or even a rainy day fund. Once your account is connected, the app transfers small amounts of money from your checking account to your Digit savings every 2 or 3 days. This app is all about setting aside some money in your savings even when you aren’t thinking about it.