This article originally appeared on Fortune.

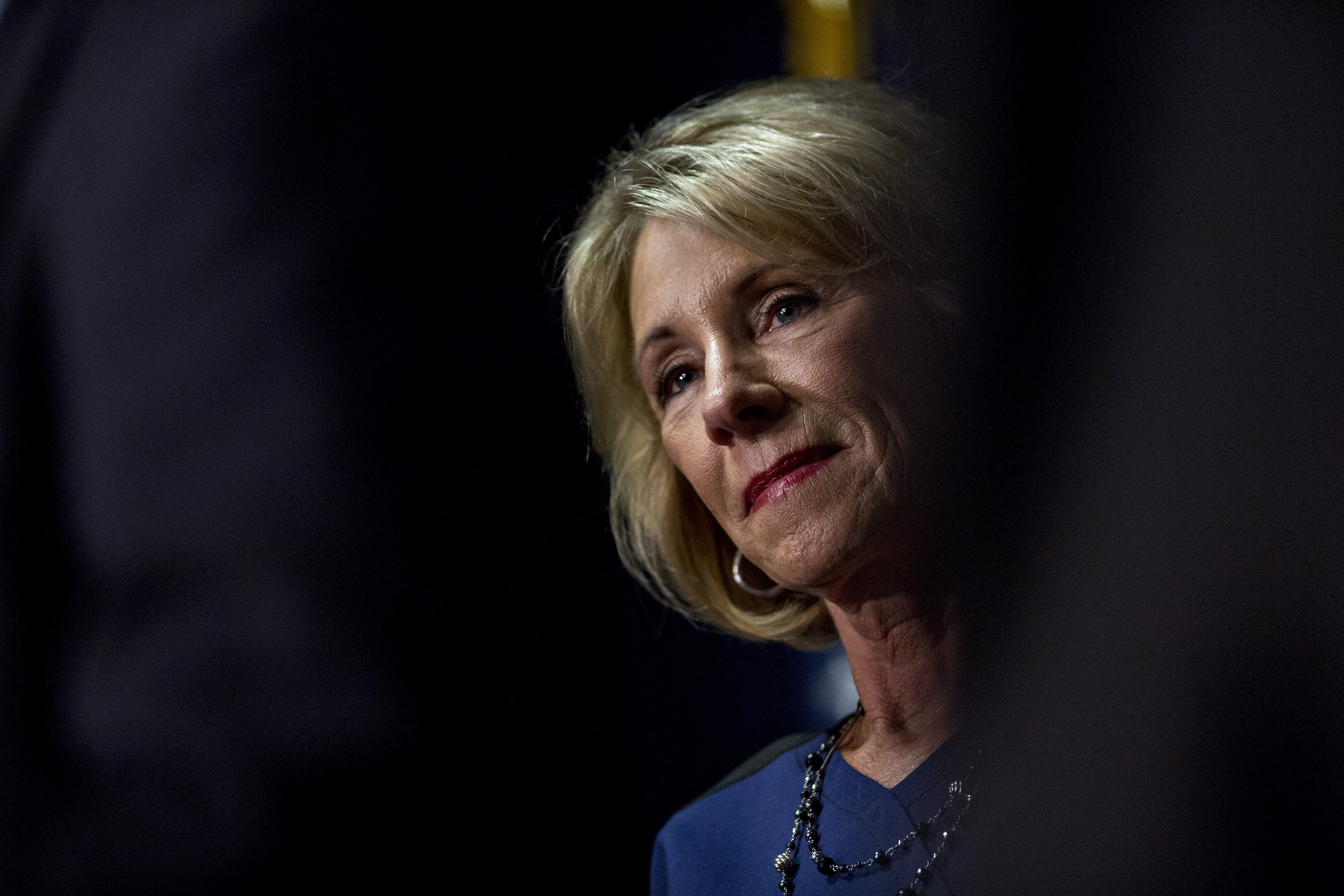

U.S. Education Secretary Betsy DeVos has been reworking student lending since her appointment in February, raising concerns among Democrats that she will undo former President Barack Obama’s overhaul of college financial aid.

On Monday, 21 state attorneys general, all Democrats, wrote to Republican DeVos decrying her decision to end the Education Department’s work on reforming loan servicing, steps intended to ensure that borrowers understand their outstanding debt and repayment options.

“We should be looking for ways to ease the burden of student debt, not enabling the student loan servicing industry to manipulate and exploit students,” New York Attorney General Eric Schneiderman said in a statement.

Under Democrat Obama, much of the $1.3 trillion business of student lending was moved from banks and other companies to the federal government. Four companies still handle servicing theloans. Last year the department began working on restrictions as well as incentives to ensure those servicers follow the law.

Subscribe to our daily newsletter for the latest in hair, beauty, style and celebrity news.

In March, the Consumer Federation of America reported that $137 billion in student loans were in default.

In an April 11 memo announcing she was stopping reform efforts, DeVos, appointed by President Donald Trump, wrote the process had been riddled with “moving deadlines, changing requirements and a lack of consistent objectives.”

“We now find ourselves in a situation where we must promptly address not only these shortcomings but also any other issues that may impede our ability to ensure borrowers do not experience deficiencies in service,” DeVos wrote, according to a version published on the department website.

The department did not immediately respond to a request for comment on the letter from the attorneys general.

The head of the Democratic National Committee, former Labor Secretary Tom Perez, said DeVos’ decision was intended to boost the profits of big corporations and counteract Obama’s reforms.

Republicans say the U.S. government should get out of the business of making student loans.

In January, the Consumer Financial Protection Bureau sued the largest loan servicer, Navient Corp, over allegations it cheated borrowers by deceiving them about repayment options and their rights.

Illinois and Washington also sued the company, which was spun off of Sallie Mae in 2014.

Navient said the bureau, created under Obama to protect people from fraud, sued because it would not settle a CFPB investigation right before Trump took office. The U.S. Department of Justice sanctioned Navient in 2014 for giving military members wrong information about their loans.