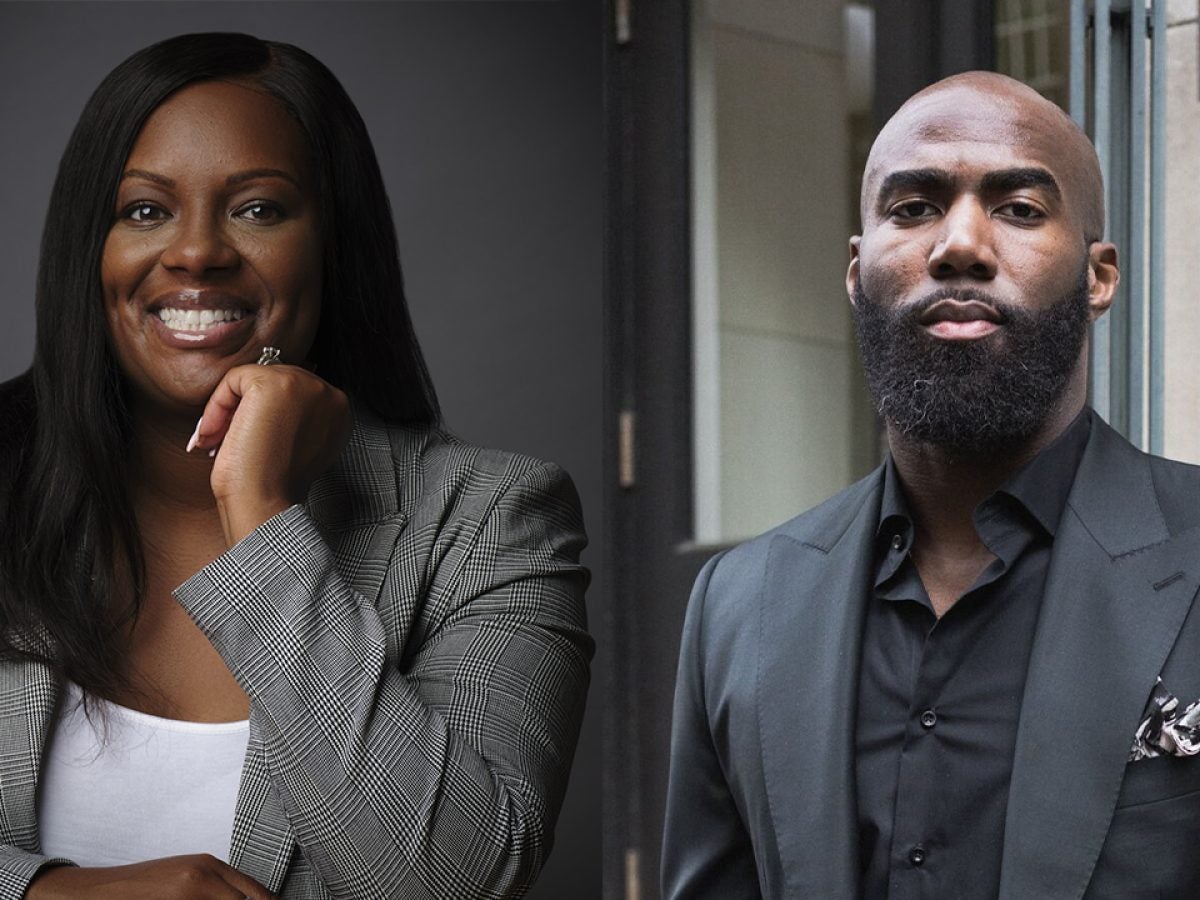

Ralonda Johnson and Malcolm Jenkins have always had each other’s backs. Since their pre-k days, the two looked out for one another and more than 20 years later, that hasn’t changed.

Although the lifelong friends took different career paths (Johnson has a background in accounting and Jenkins was drafted to the NFL in 2009) they frequently checked in with each other to ensure they were making the best decisions for their lives.

“Ralonda has always been one of my greatest advisors,” Jenkins said, referring to his friend’s position as the head of his management firm Malcolm Inc. “Everything you see from a business standpoint has been directly influenced by her.”

Jenkins says this early financial guidance was critical at the time he was drafted as a then 22-year-old Black male professional athlete with high earning potential, a position that could’ve gone awry if not careful. It’s reported that about 78% of NFL players file for bankruptcy shortly after their retirement despite earning millions through their career.

“Two things that really were false narratives I believed in was that first, being in the NFL was going to earn you generational wealth just by playing and secondly, you were guaranteed to be worth millions of dollars while in the league,” Jenkins said. “With the help of Rolanda, I realized once I was done with my first contract, I had to produce multiple streams of income to live the life I wanted.”

Johnson, a double-graduate of Rutgers’ school of accounting and business, had an early understanding of financial health.

“My mom taught me as a girl to never spend everything I had, and that thinking carried over into adulthood, which is what I shared with Malcolm every step of the way, especially after realizing the NFL doesn’t always take steps to set their players up for financial success.”

She mentioned that although players are set up with financial advisors through the league, their involvement left a lot to be desired.

“Unfortunately, with some advisors, there’s a stigma that athletes aren’t intelligent so I don’t think they’re doing all they can for them,” she explained. “But then they’re also in a tricky situation because you don’t know what the athlete’s career span is to be in the coming years. They might unfortunately get hurt during their first season. So, for the advisors, their approach is, “I’m going to just help you save the money that you have without identifying opportunities for wealth building.’”

That’s why the two decided to launch the Broad Street Ventures venture capital fund for athletes aiming to build financial security in 2020. Along with a team of advisors, the venture is managing BSV’s $10 million vehicle. Their investment portfolio includes companies like Airbnb, Epic Games, Turo, NoBull, Automattic, Udemy, Dapper Labs, Therabody (Theragun), Preziba (Signos), Instacart, Papa and ZenWtr.

Per a news release, other Broad Street Ventures investors include three-time Super Bowl Champion Devin McCourty (New England Patriots), Super Bowl Champion Jason McCourty (Miami Dolphins), Jordan Matthews (San Francisco 49ers), Super Bowl Champion Rodney McLeod (Philadelphia Eagles), three-time Super Bowl Champion Duron Harmon (Atlanta Falcons), Super Bowl Champion Jacoby Brissett (Miami Dolphins), Sharrie Williams (television broadcaster) and Ralonda Johnson (Malcolm, Inc) among others who chose not to be disclosed.

“We’re only in the first year and half of the fund,” said Jenkins. “It’s exciting to really have this vision, have it come to fruition and put the people that you want in places of power, doing the job exactly how you want it to be done is an awesome feeling.”