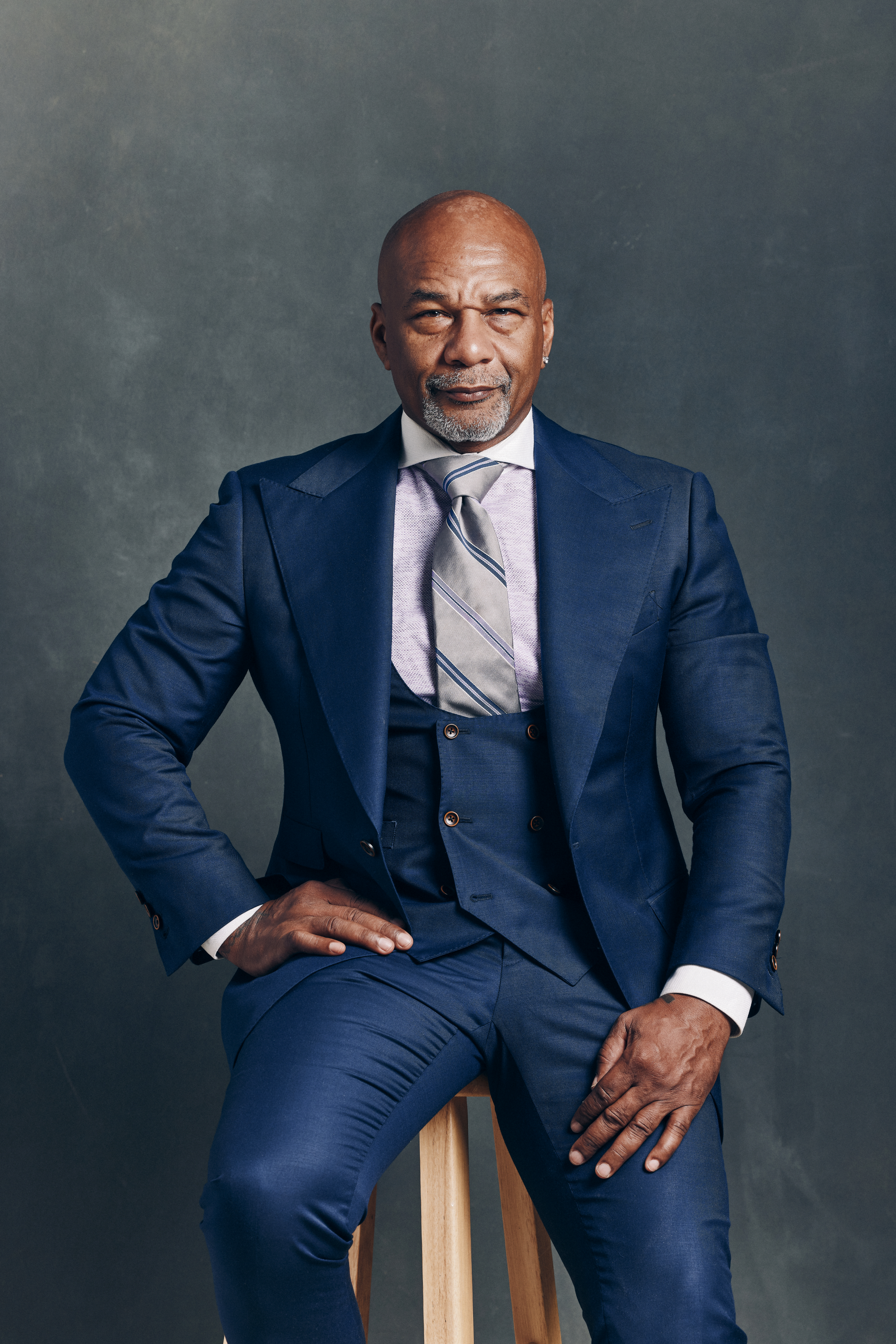

In 2012, Miguel Wilson filed for chapter 7 bankruptcy, got divorced, owed the IRS $1 million, and self admittedly was on a downward spiral to the bottom.

He founded his menswear brand in 1993 with the intention of leaning into his fashion talents while making a decent living, but after over a decade in business, he didn’t account for an economic downturn and a fickle consumer base that couldn’t afford the bespoke clothing he designed. Wilson also had a real estate company, which was struggling too due to a fledgling market at the time. He was in deep trouble.

“I just wasn’t pulling in enough money, plain and simple.”

After coming to the realization that he couldn’t keep up with his bills and mounting tax debt, the decision to file bankruptcy was the only path forward. But it was a devastating one.

“I definitely felt like a failure,” Wilson told ESSENCE. “No one sets out to start a business with failing in mind. I was really, really ashamed.”

His story is a familiar one.

The number of personal bankruptcy filings in the United States has steadily increased over the last four decades, with 370,685 cases in 2022 alone. Although bankruptcy is supposed to be clinical in nature, there are deep stigmas and emotional trauma attached to the process.

According to 2022 survey findings from polling platform OnePoll, 58% of those surveyed feel alone in experiencing financial stress and 51% are ashamed of their financial difficulties. Additionally, 2021 data from Experian also show that the average American has a consumer debt balance of $96,371, up 3.9% from 2020 stemming from medical bills, mortgages, credit cards balances and unpaid student loans.

Much like Wilson, people who file Chapter 7 personal bankruptcy are in need of a “reset” course of action because it is a “liquidation” bankruptcy that doesn’t require a repayment plan but does require you to sell some assets to pay creditors, according to experts.

“I was shocked honestly because I felt such huge sense of relief {once I started going through the process},” Wilson told ESSENCE. He also shared that he’d always associated bankruptcy with failure and was deeply ashamed when his money troubles started. “You know, as a Black man, being financially successful means a lot so when that doesn’t happen, it’s shameful.”

Despite data showing that the average US millionaire files for bankruptcy 3.5 times in their lifetimes, this inherent shame Wilson felt likely stemmed from systemic inequities that have long contributed to the disenfranchisement of Black people. In 2019 the median white household held $188,200 in wealth—7.8 times that of the typical Black household. From slavery and redlining, to even recent instances of biased banking practices, Black people are consistently at a disadvantage. To make matters worse, research findings suggest debt collectors disproportionately harass Black debtors than non-minorities in the same amount of debt.

“Our community ties so much emotion to the word broke,” Nicole Stanton, Esq. told ESSENCE. She is a founding partner of Atlanta,Ga-based bankruptcy firm Stanton & Worthy, (formerly owned by Johnny Cochran) and regularly counsels clients on the legal, financial and emotional implications tied to debt repayment. “It’s really embedded in our culture from our music, TV shows and everything. For example, I’ll admit I love that song Broke Boys by Drake but when you’re really listening to this stuff, it’s subconsciously perpetuating financial shame. Candidly speaking, it does not mean that you are a failure at all, period.”

She admits that the stigmas attached also stem from a lack of financial education.

“I think a lot of people are just ignorant to filing, and debtors use that insight to scare people,” Stanton explained. “A lot of creditors call people and tell them ‘we’re going to put you in jail,’ among other threats, but that is not true at all.”

Stanton also explained that she often steers prospective clients away from bankruptcy unless it’s their absolute best recourse.

“Bankruptcy is a huge commitment,” Stanton explained, pointing out that most individuals can take between three to five years to complete a debt repayment plan and discharge their bankruptcy case.

But there’s hope.

As Wilson pointed out, he was hugely relieved once he was able to reorganize his finances and stave off creditors. The extra time gave him the breathing room to pivot his business strategy and recoup lost profit.

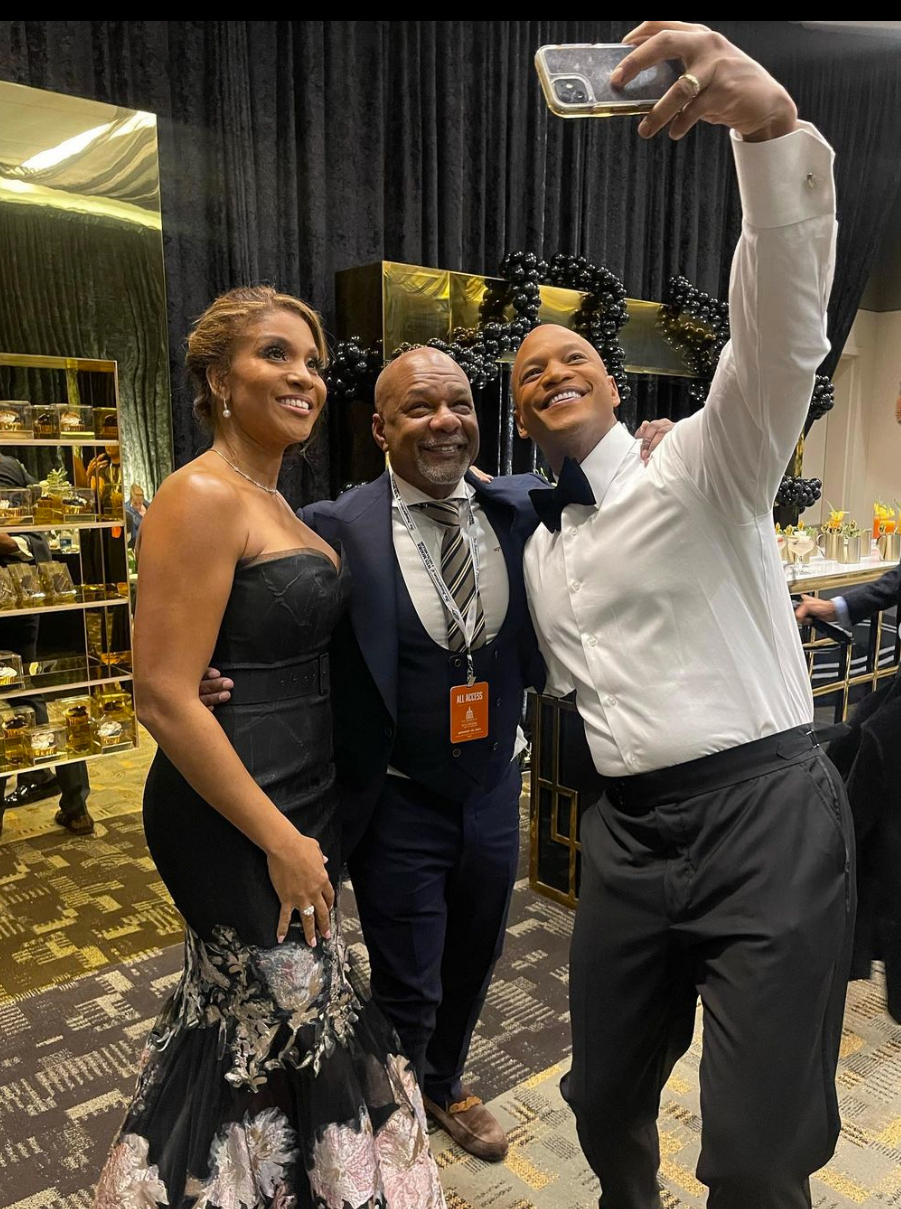

“Today, I run a multimillion-dollar company, serving clients across the United States and I’m not sure I would’ve been able to do that without filing,” he shared with ESSENCE. He most recently made headlines by outfitting newly elected Maryland Governor Wes Moore for his inauguration, the first Black man to hold the post. “I’m really proud of the success but more than anything, I’m just glad I have control of my finances again.”

Stanton also points out that, unlike their white counterparts, Black business owners hold a disproportionate amount of shame when financial challenges hit, but they shouldn’t.

“{Bankruptcy} is not personal,” said Stanton. “You can reorganize your debt, so that’s why we frame it like you’re reorganizing it. You’re starting fresh and offering yourself permission to regain control. It’s putting you back in a position of power so you’re not reacting to your financial situation. You’re taking back your power.”