We all know the importance of maintaining a healthy credit score. But have you ever heard of a business credit score? Small business owners, solopreneurs and even some freelancers should be aware of the concept as it determines the susceptibility of receiving loans.

So, what is it?

Bankrate.com describes a business credit score as a report provided to credit agencies, loan issuers and vendors or suppliers with a general idea of how trustworthy you are when it comes to borrowing money.

The score is determined by details like the number of workers a business employs, past payment history, amounts owed, credit utilization among other factors.

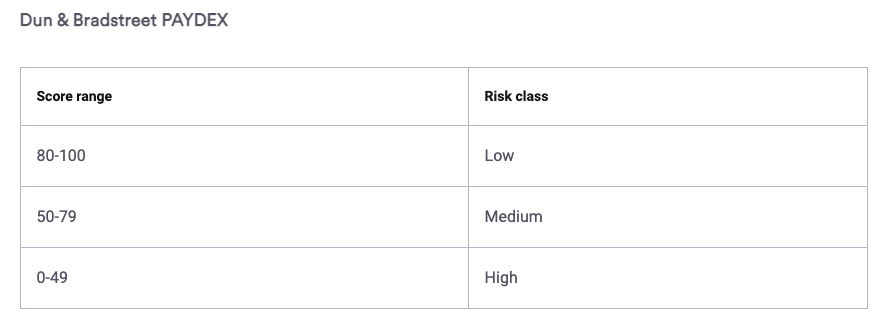

What differentiates the business credit score from your personal one is it doesn’t necessarily follow the same numerical pattern. Business credit scores are usually arranged from 0 to 100, while others using the FICO Small Business Scoring Service (FICO SBSS) range from 0 to 300.

How do I build a strong business credit score?

Well, first it’s important to know where you land on the scale by accessing a business credit report. Experian allows you to access the report for a cost of $39 – $399.95 depending on how many you need.

Once you have an understanding of where you are, it’s time to map out how to make it as strong as possible.

Much like your personal credit score, building a high business credit score requires a bit of diligence and time.

Pay your bills on time no matter what.

Be sure to set your bills on autopay if you can as to avoid late payments. Missing deadlines can result in negative marks on your report that can take time to remove or fall off.

Set up trackable business credit lines.

Not all business creditors report trade lines and lines of credit are created equal. Obtaining a business credit card is the best way to start establishing business credit.

Watch the credit score closely.

Using tools like Experian’s online small business hub to set up alerts is a great way to stay abreast of your credit history and real-time activity.