Pretty much everyone has a credit card.

More than 570 million credit card accounts in the U.S. were open and active as of 2022, and at least 84% of adults have at least one card in their wallet. But as common as they are, few credit card holders truly understand how to properly use them, particularly after they’ve already amassed debt. Building awareness around your pay down options is crucial, especially at a time when credit card debt has become crippling for many people; the average debt hit $1 trillion this year.

Fortunately the option to consolidate the debt is a smart way to get a handle on the debt if it has spiraled out of control, but it’s important to go about the process in an informed way.

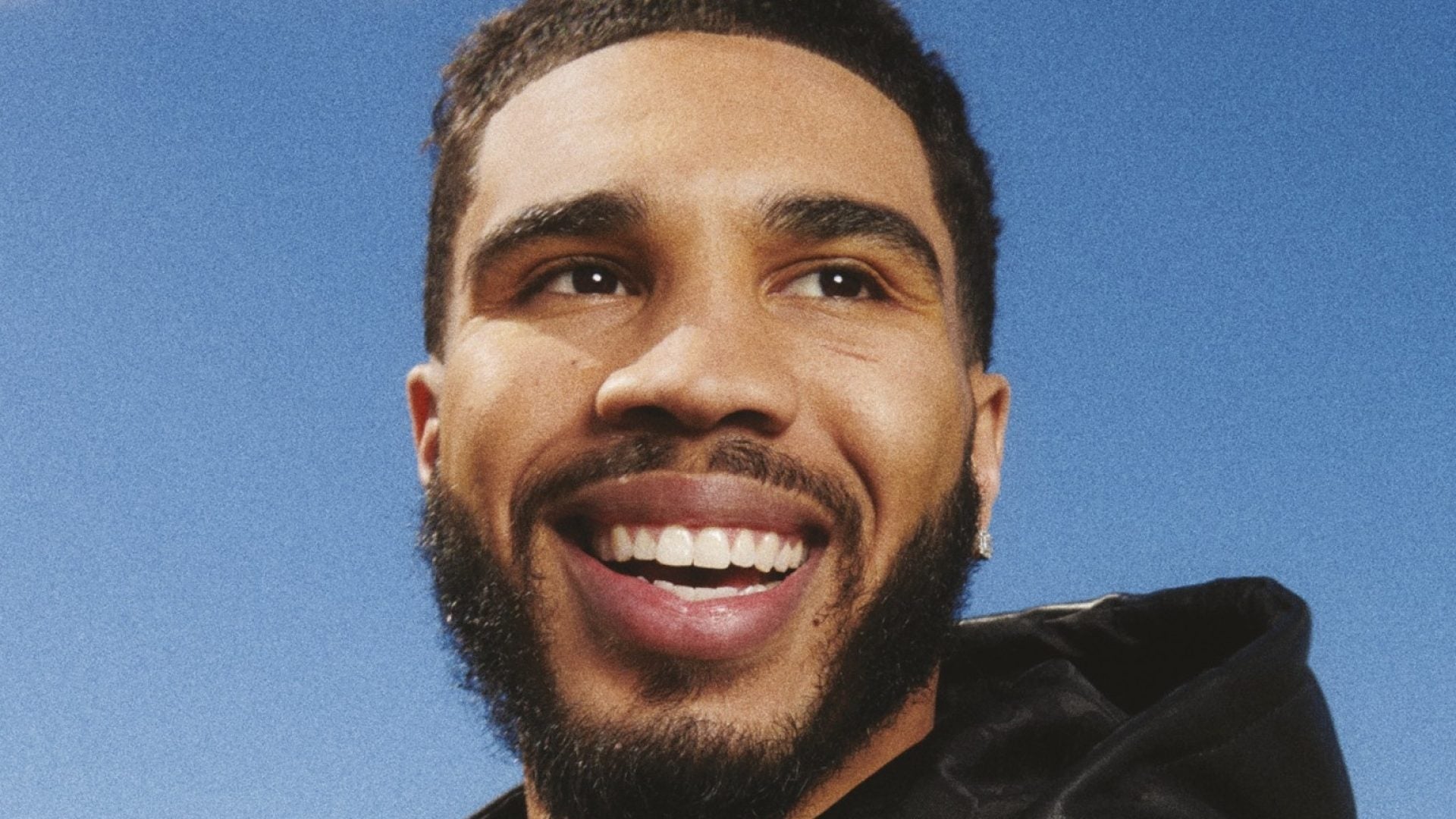

Kimaria Howard, a financial representative with Northwestern Mutual, discusses what we should know beforer taking that step.

What’s the first step we should take when considering credit card consolidation?

Kimaria Howard: I think it’s important to make sure we find out what debt you have first and, how much your interest rates are. Then it’s best to go over what your credit utilization looks like because that determines which options you may have available to you.

You can apply for a consolidation loan, in which fund are allocated so you can pay down all your credit card debt at once, then just pay one creditor instead of paying multiple creditors with different interest rates. Some providers have interest-free promotional rates for about a year generally, and you can roll all of those credit cards into one credit card that has the free promotional rate for a year and try to pay that off before that introductory period is over to avoid interest. But you want to make sure that you know what the balance transfer fee is as well when consolidating debt with credit.

Then there’s also consolidating with home equity. With that, you can do a cash-out refinance, which is essentially getting a new loan based on the value of your home, and then the proceeds will pay off the existing mortgage balance and the remaining funds can be used for however you want. And then there’s also a home equity loan, which is basically a second mortgage, and it has its own terms to repay it. But with that, you use the equity that you have in your home to use for collateral.

Personal finance can be very emotional, especially for the Black community. Many of us have not had those early conversations about money management and debt strategy. When you come face to face with clients who want to get out of debt but don’t necessarily have the wherewithal to take that first step, what do you usually say to them?

I try to connect to what they’ve learned in the past. First, a lot of times we don’t think about the trauma bonds we have with money—where they came from, and how to eradicate them because and we’re in survival mode. After taking that step back to have that conversation with the client, I then try to their savings philosophy and debt philosophy as well. Northwestern Mutual‘s latest Planning And Progress Study, suggested that despite African Americans high debt to income ratio, we’re more likely to prioritize saving money before paying down debt, compared to 39% of national average. So, I know that we as Black people, we have a propensity to want to make sure we protect ourselves and get ready for any emergencies over dealing with debt. And I think we have to learn the balance of it and knowing that, yes, it’s important to save, but also, in order to do more and propel the next generation, we have to do better about balance with our finances.

How is Northwestern Mutual helping individuals that want to take this step.

All of our advisors are well versed in financial education. We talk about all those things in training, and a lot of us have a financial background already. What we do is holistic planning. So, it’s not just about how much debt you have. It’s about helping you with budget planning, savings building, and life insurance. It’s not about just one of those things, it’s about taking a look at all of these elements to ensure that there is a clear financial plan available for each client. We work through it all together, one step at a time.