On Tuesday the United States Senate approved a $484 billion coronavirus relief package that’s expected to pour billions more into the Paycheck Protection Program (PPP) intended to give small businesses financial relief during pandemic-spurred shutdowns. Of the $310 billion set aside for the PPP, just $60 billion will go to assist small lenders and community-based financial institutions.

Advocates say it’s simply not enough.

“Businesses of color employ more than 8.7 million Americans and generate more than $1.38 trillion to the overall economy. The Senate is exacting damage on whole communities, states and regions when these businesses cannot access the Small Business Administration’s PPP funds to keep their doors open and maintain their employees,” said Ashley Harrington, federal advocacy director and senior counsel for the Center for Responsible Lending in a statement shared with ESSENCE. “Businesses of color were locked out of round one of the SBA PPP, and the Senate’s new proposal fails to ensure that they will have access to the new $310 billion.”

Access to capital has long been an issue for Black business owners who, according to the U.S. Federal Reserve, are denied loans at twice the rate of their White counterparts. In fact, less than 47 percent of loan applications completed by Black-owned firms are fully funded, yet they remain one of the fastest-growing demographics of entrepreneurs in the U.S. Capital for the majority of these businesses are not from larger SBA-approved banks. Instead, the money comes from personal credit cards or Black-owned financial institutions that have consistently filled in the gaps created by big banks who have a history of employing discriminatory lending.

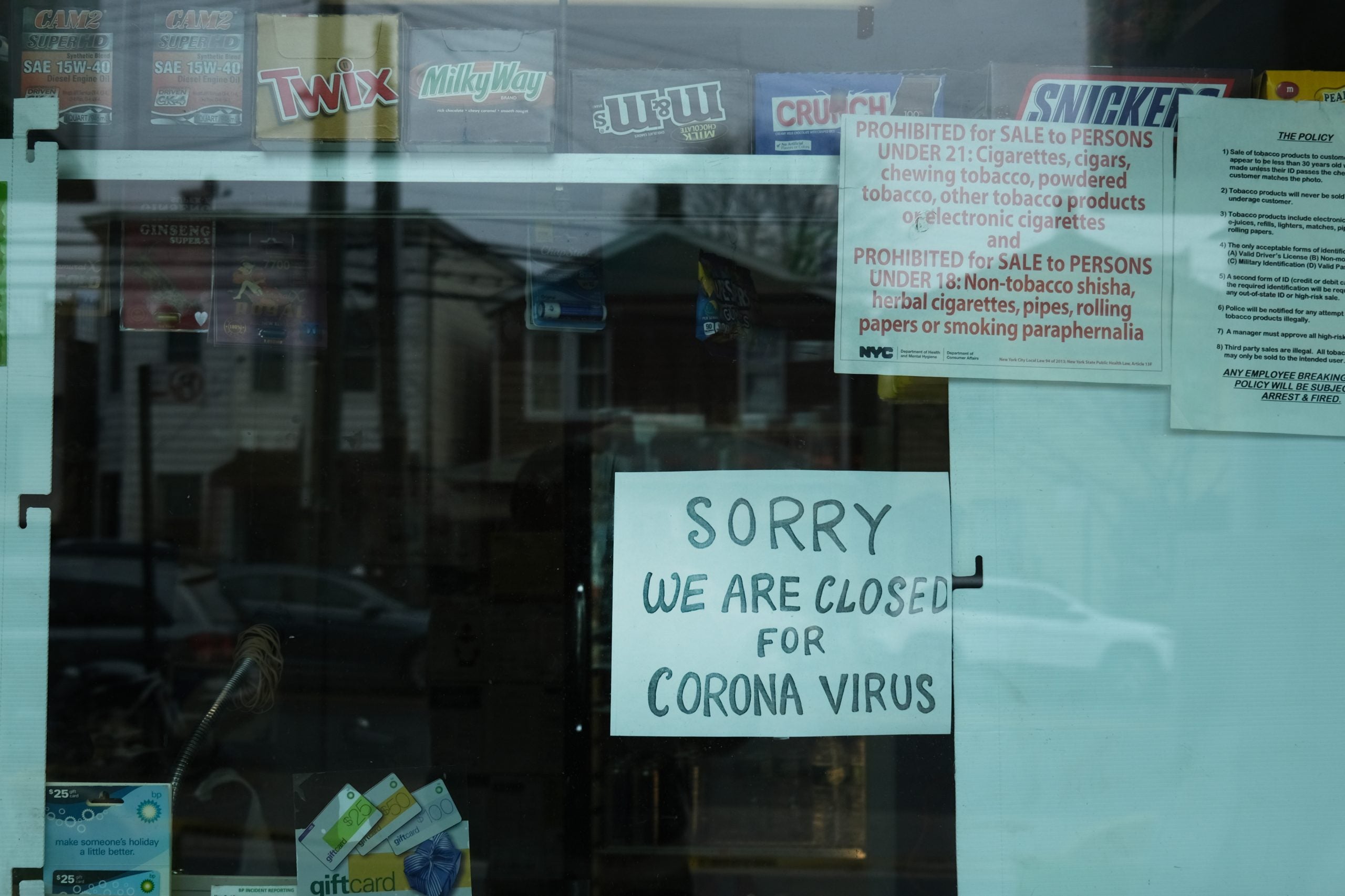

In terms of the coronavirus, that has presented a significant challenge to Black-owned businesses that aren’t able to collect on money from the PPP because larger firms are prioritizing businesses with which they already have a standing customer relationship. Teri Williams, president of OneUnited Bank, America’s largest Black-owned bank, was critical of this caveat during the first rollout of the PPP.

“When you roll out such a big program in a short, short period of time, the big guys can immediately turn on a dime. They got a thousand employees and they can get this up and running very quickly,” Williams shares with ESSENCE. “The community banks, it takes us a little longer to figure this out. And so in some ways, it would have been helpful if they had set some money specifically aside for Black businesses or for community banks, as opposed to letting the bigger guys who, again, are just offering it to their customers to sort of gobble all the money.”

In the last week, this was made glaringly obvious when it came to light that multimillion-dollar companies had cashed in on the fund set aside for small businesses. Restaurant chains that grossed more than half a billion dollars last year collected millions from the PPP. Even small businesses that obtained loans from big banks had a hard time reaping the benefits of the bipartisan effort. Black businesses with no relationship at all were further sidelined. And critics of the bill say the stipulations set forth in the new wave of funding doesn’t ensure that this will not happen again.

“This bill distributes most of the funding again to large banks that prioritized wealthier businesses over small businesses,” Harrington insists. “It includes set-asides for community banks and credit unions. Unfortunately, they have poor track records of serving borrowers of color. Instead, the proposal should have provided specific dollar funding for CDFIs and MDIs, as they have the strongest track record of serving borrowers of color and are least likely to access PPP funding under its current structure.”

Another critique of the bill that is expected to go to a House vote this week, is that it does not ensure equity and transparency. It’s a concern expressed by Senator Kamala Harris (D-CA) who tweeted last week, “I joined my colleagues this week calling for data transparency on small business loans to make sure that people of color aren’t being shut out from help during a pandemic.”

Her sentiments were echoed by the Congressional Black Caucus, who released a statement following the Senate passage of the relief aid bill. While the CBC congratulated Speaker Pelosi and Democratic leadership for being able to secure the PPP provision that will assist small lenders and minority-based financial institutions in getting money to minority-owned businesses, they say “much more needs to be done.” This includes collecting accurate data on not just the death rate of African-Americans during this pandemic, but a “complete picture” of how this virus is affecting our community.

“We hope that the SBA will step up where Congress has failed and take steps to ensure equitable access to this program so that all communities are able to weather this storm,” Harrington challenges. “The SBA can specifically allocate resources for CDFIs and MDIs and it can require robust data collection from all participating lenders. Wealthy companies already got more than their fair share of the PPP, now it’s time for small businesses owned by Blacks, Latinos, Asian-Americans and Pacific Islanders, and Native Americans to have the access they were denied.”